The Italian DIY and garden market report (2/2024) – Part 1

Today starts the publication of the DIY-garden monitoring regarding the second semester of 2024. We publish today the first part of the report, while the second part will be released next week.

The Italian network of stores linked to the 26 distribution groups of specialized organized retail in the brico-garden sector in 2024 has not seen major changes.

The concept of a “DIY center,” meant as a self-service, multi-product store specializing in tools and hardware for the home, likely originated before the 1980s through the initiative of “enlightened” independent entrepreneurs. However, Specialized Large-Scale Retail, and thus the idea of creating a chain of brico-garden stores, came to life in Italy in the early 1980s, forty years ago.

The first to recognize its potential were the major retailers of large-scale distribution (LSD), often following stimuli and models from Northern Europe. In 1982, Finiper inaugurated the first Bric Market store in Torrazza Coste (PV), later sold to Castorama and now operating under the Leroy Merlin banner. In 1983, Bricocenter was born, then promoted by La Rinascente, with the first store in Venaria Reale (TO). Brico io (Coop Lombardia) and the German Obi (Tengelmann Group) are also specialized projects developed by LSD groups.

In 1990, the number of Italian Specialized Large-Scale Retail DIY centers had already risen to 41, and a decade of enormous growth began, thanks also to the start of affiliation policies and the establishment of consortia and purchasing groups specializing in DIY, such as Punto Legno and Fdt Group, and in gardening, such as Giardinia and Garden Team. In 2000, the number of stores rose to 334 (+714% in ten years), equivalent to over 672,000 square meters of exhibition space (+537%). In 2003, the “wall” of 1 million square meters of exhibition space was broken, and in seven years, it nearly doubled: in 2010, the number of stores rose to 882 (+164% compared to 2000), equivalent to 1.971 million square meters of exhibition space (+193%).

In the following decade, 2010/2020, growth continued but showed a certain stability: in 2020, 1,173 stores linked to specialized organized distribution were active (+27% compared to 2010), equivalent to 2.5 million square meters (+33%). The various economic and financial crises experienced in the last fifteen years, including those resulting from Covid and the various war conflicts, have certainly not stimulated investments in the creation of new specialized centers, already challenged by the simultaneous development of international e-commerce.

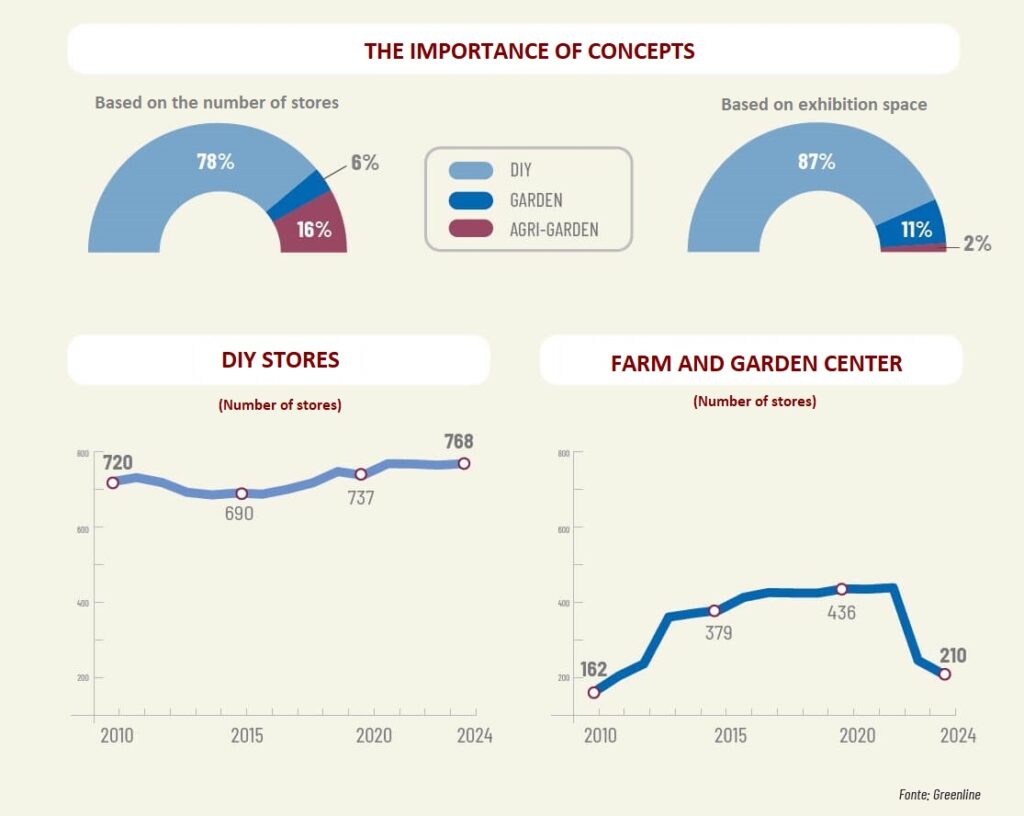

Also in 2024, the general trend of the 26 distribution groups analyzed is one of stability. DIY center chains have 768 stores, 4 more than in 2023 (+0.5%), garden centers are stable, while agri-gardens are experiencing a slight decrease, partly due to the reorganization of the Tuttogiardino brand, which went from over 300 served stores to the current 120, of which over 90 with the chain’s brand and identity.

Specialized Retail DIY-Garden in 2024: DIY in Italy

The majority of the 978 total points of sale are located in the north of the country, where over 60% of the stores and exhibition spaces are found. The regions of central Italy host 22% of the stores, while the area encompassing the south and islands sees 18% of the points of sale.

The region with the highest concentration of stores is Lombardy, with 168 points of sale (164 at the end of 2023). It is also the one with the highest number of brands present: there are 18. In this particular ranking, it precedes Piedmont (16 groups present), Veneto (15), Emilia Romagna and Friuli (14). Instead, the most widespread chains are Bricofer and Bricolife, present in 17 Italian regions, followed by Brico io, Brico Ok and Bricocenter, present in 16 regions.

Only 23% of the points of sale are located in cities, that is, provincial capitals, but they represent 29% of the exhibition space.

Geographic distribution

It is evident how the larger population and the presence of large metropolises attract greater attention, more points of sale, and larger exhibition spaces. By relating the exhibition space to the population, we find that on average, Italians have 4,221 square meters available per 100,000 inhabitants.

In the northeastern regions, it rises to 5,704 square meters per 100,000 inhabitants, with peaks in Friuli (8,528 square meters) and Trentino (6,641 square meters). The specialized distribution group with the highest number of stores in the northeast is Tuttogiardino with 115 supplied stores. Followed by Bricolife (31), Brico io (24), Brico Ok (23) and Obi (22).

The northwestern regions, with an average of 5,571 square meters, are quite aligned, thanks to the peaks in Piedmont (5,935 square meters) and Lombardy (5,642 square meters). In the northwest, Brico Ok stands out, with 56 stores, followed by Brico io (33), Bricocenter (25), Fdt Group (22), and Leroy Merlin (19).

The central Italy area has an average of 4,162 square meters per 100,000 inhabitants, slightly below the national average. Umbria (5,978 square meters), Marche (4,416 square meters), and Tuscany (4,310 square meters) are above average, while Abruzzo (4,165 square meters) and especially Lazio (3,729 square meters) lag behind.

In central Italy, Brico io is the most present chain with 49 stores; followed by Bricofer (36), Bricolife (27), Obi, and Brico Ok (18).

The south and islands area stops at 2,250 square meters per 100,000 inhabitants, and only Sardinia reveals a result above the national average, with 4,996 square meters.

In this macro area, Evoluzione Brico (27), Bricofer (22), Brico Ok (21), Bricolife (18), and Brico io (13) stand out.

If we shift our attention from the number of points of sale to the total exhibition spaces, we find Leroy Merlin at the top positions in all macro areas, with the exception of the northeast where it is preceded by Obi.

DIY centers in Italy

If we analyze only DIY centers, the numerically and statistically most relevant category with 78% of the stores and 87% of the exhibition space of the total sample, we find that the importance of the north is slightly reduced. 50% of the stores and 57% of the exhibition spaces are present, compared to 26% in the central regions and 22% in the southern and island areas.

The numbers tell us that in the north, stores have larger average sizes, while in the rest of the country, convenience and medium-sized stores are concentrated, also considering the population and the particular Italian geographical conformation. In the south, we find 22% of the stores but 19% of the exhibition spaces.

Even in the DIY world, Lombardy dominates with 141 DIY centers and over 459,000 square meters of exhibition space. It precedes Piedmont, with 79 centers and 232,000 square meters, and Lazio (71 centers and 216,000 square meters).

In Lazio, however, the performance of Rome stands out, with 41 stores: 10 more than Milan. In the ranking by number of DIY centers, after Rome and Milan, we find Turin (24) and many medium-sized cities: Brescia (23), Varese (18), Latina (16), Perugia, Cosenza (14), Novara and Trento (13). If, on the other hand, we analyze the ranking by exhibition space, after Rome, Milan and Turin, Brescia, Varese, Monza, Udine, Vicenza, Bergamo and Naples stand out.

Research methodology. The ‘Specialized Large-Scale Retail DIY-garden Monitoring’ is a biannual survey that the author has been conducting continuously since 1988. To analyze the evolution of specialized organized retail formats in DIY and gardening operating in Italy, we have selected the Specialized Large-Scale Distribution brands and Purchasing Groups (consortia, voluntary unions, etc.) that meet two main requirements: the presence of at least 3 points of sale and a propensity for development, i.e., the systematic opening of new owned (direct) or affiliated points of sale. The indicated exhibition areas refer to covered areas intended for sale: therefore, parking lots, offices, and warehouses are excluded. By ‘direct’ points of sale, we mean stores owned by the distribution group; by ‘affiliates,’ we mean stores owned by private entrepreneurs who adhere to distribution association formulas (such as franchising) or affiliation with purchasing groups and consortia. All data are provided by the brands themselves and processed by the author. The rare estimates are always specified in the graphs.