The Italian DIY and garden market report (1/2024)

Here’s our report on how the Italian DIY and garden market did in the first half of 2024.

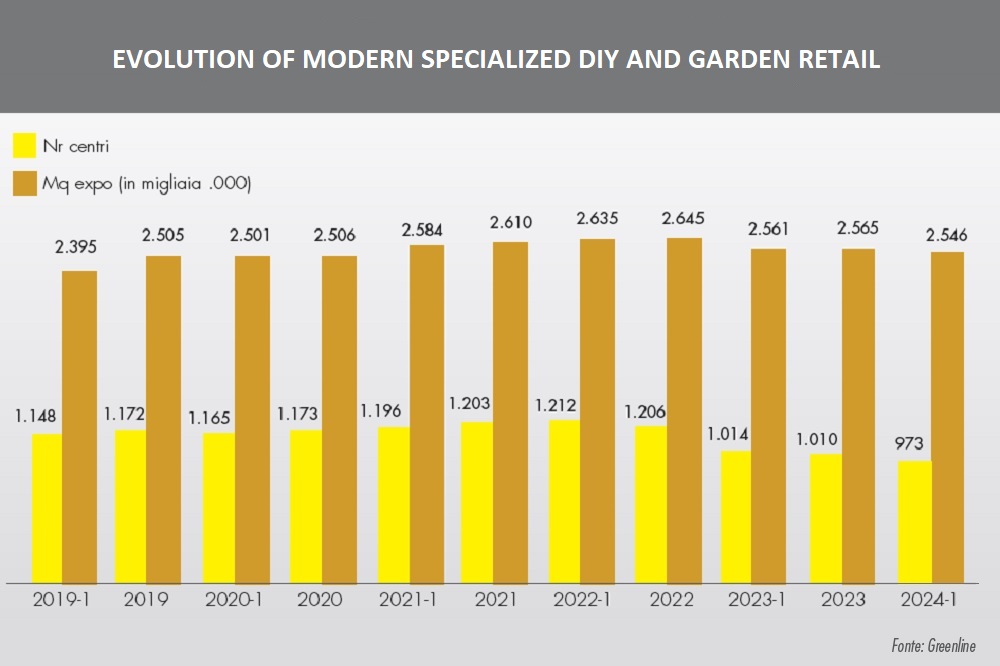

In the first half of 2024, the network of specialized DIY and gardening stores within Organized Distribution, i.e., those affiliated with GDO brands or purchasing groups, remained essentially stable in terms of numbers and showed no significant signs of growth. In fact, the total number of stores decreased by 37 units, primarily due to the ongoing reorganization of the Tuttogiardino store network, which went from 154 stores at the end of 2023 to the current 118, almost all now branded with the hedgehog logo and the Italian chain’s image.

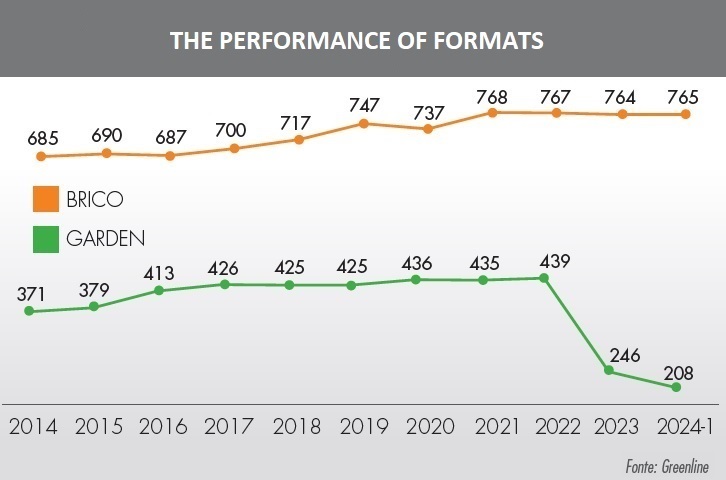

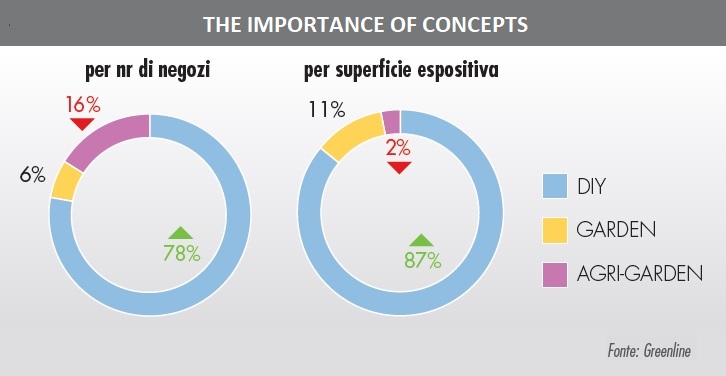

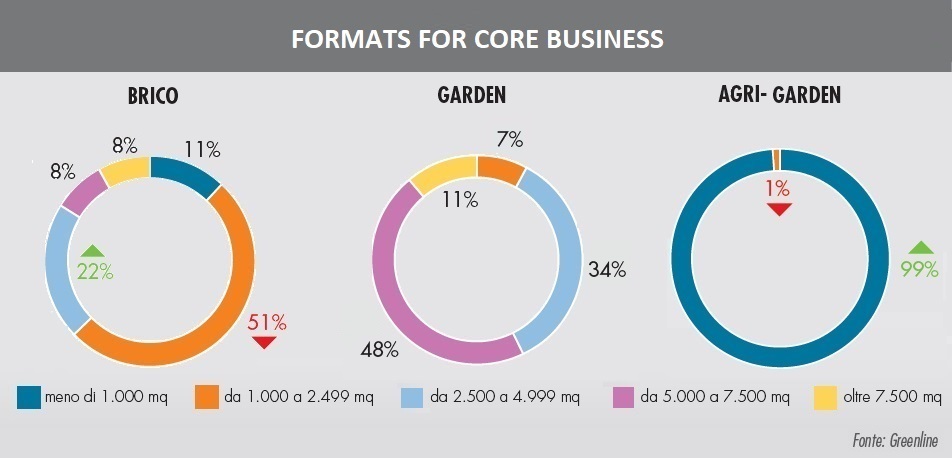

Overall, the number of stores dropped to 973, representing a decrease of -3.7% compared to the 1,010 at the end of 2023 and -4% compared to the 1,014 a year ago (June 30, 2023). Since Tuttogiardino stores have limited square footage, the total retail space decreased by only -0.7%, from 2.565 million square meters at the end of 2023 to the current 2.546. Analyzing the 3 “core businesses” into which we have divided the stores, a certain stability emerges: there are 765 DIY centers with an increase of 1 store compared to the end of 2023, and garden centers are stable with 56 stores linked to 3 groups. The only decline is recorded among agri-garden centers where both chains that make up the category have reported a decrease in stores.

New openings in 2024

It’s important to clarify that these numbers represent a balance between new stores opened and those “closed”; in quotation marks because in most cases it’s not about actual business closures, but rather the departure of independent retailers from franchising and other forms of association. These stores often continue independently or join another group shortly after.

A neutral or negative result for a brand does not mean that it did not operate in 2024. For example, the Brico Ok consortium opened two new stores, on May 10th in Sant’Angelo Lodigiano (LO) and on June 14th in the Iperal shopping center in Prata Camportaccio (SO).

Brico io, which now competes with Brico Ok for the highest number of stores, also inaugurated two affiliated stores on March 22nd in Deiva Marina (SP) and on May 7th in Ischia (NA).

In La Spezia, the first Obi store in Liguria was also opened on March 1st: with a sales area of 5,140 square meters, it is the largest store opened in the first half of 2024.

On June 27th, the Bricocenter store in Trapani reopened after remodeling. In the first months of this year, the Groupe Adeo chain also renovated the stores in Muggia (TS), Terni, Lecce Surbo, and the historic store in Cinisello Balsamo (MI) opened in 1984.

Among the consortia, Evoluzione Brico consolidated its position in Sicily in February with the store in Gela (CL) and in March in Caltagirone (CT). With 16 points of sale in 7 provinces, Evoluzione Brico is the most widespread chain in Sicily. In 2024, it also completed the restyling of the Bricolarge store in Bovalino (RC).

The Fdt Group consortium also opened a store in Sicily, on May 2nd in Piazza Armerina (EN) on a sales area of 2,000 square meters.

Utility opened its 21st store in Arona (NO), while Pronto Hobby opened its 7th store in Catanzaro on June 28th. Pronto Hobby is the DIY brand promoted by Gruppo Raffaele, a wholesale business partner of Gieffe.

Finally, it’s worth mentioning the activity of Leroy Merlin Italia, which in 2024 promoted the new Showroom bagno format: after Rome, Milan, and Florence, it also arrived in Trapani on January 25th. Similarly, it worked on the inauguration of the new Corsico (MI) Building Center, opened on July 9th. At the same time, it is involved in the launch of the new marketplace on its e-shop.

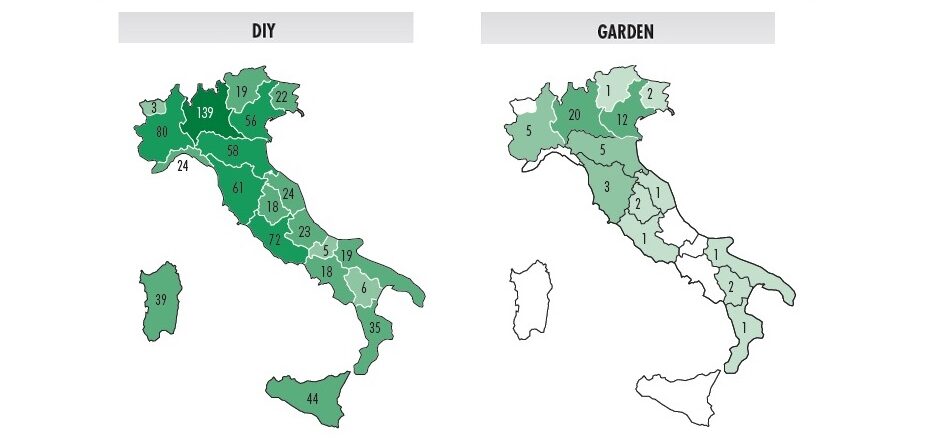

The geography of retail

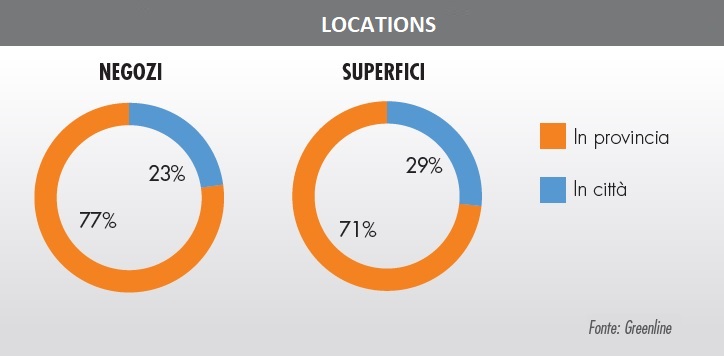

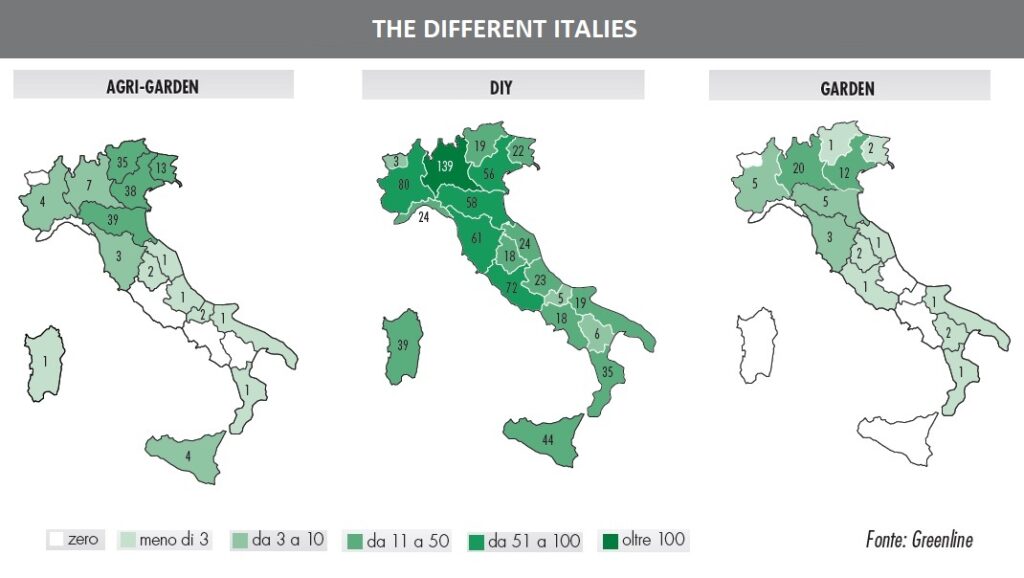

Despite the loss of many stores, especially in the north-east, 60% of stores continue to be located in the northern regions: 29% in the north-west and 31% in the north-east. If we shift our attention to the sales area, the north-west recovers and represents 35% of the Italian total, while the north-east “stops” at 26%. In central Italy, we find 22% of stores and in the south+islands area, 18% (17% of the floor space).

The region with the highest number of stores is Lombardy (167), followed by Veneto (108) and Emilia Romagna (102): these are the only regions with more than 100 stores.

If we shift our attention to the ratio between stores and population, due to the decline in stores as of June 30, 2024, there were on average 1.65 stores and 4,327 square meters per 100,000 inhabitants in Italy. At the end of 2023, there were 1.72 stores and 4,359 square meters.

In the north-east, the averages rise to 2.61 stores and 5,716 square meters per 100,000 inhabitants, with the “peak” in Friuli with 3.02 stores and 8,486 square meters. It is the most “served” region, with 36 stores and over 101,000 square meters of total sales area for less than 1.2 million inhabitants.

In the north-west, the averages stop at 1.78 stores and 5,658 square meters per 100,000 inhabitants, with the “peak” in Lombardy with 5,665 square meters.

The central regions are fairly aligned with the national average, with the exception of Umbria, with 2.58 stores and 6,191 square meters per 100,000 inhabitants (remember that it has only 854,137).

The southern regions, on the other hand, are well below the national average. Sardinia deserves a mention, with 2.54 stores and 5,035 square meters, therefore with averages from central-northern Italy.

The DIY cities

The cities with the highest number of stores are Rome and Treviso (42), followed by Milan (38) and Trento (29). If we analyze the sales area instead, Milan takes the first place with 182,500 square meters, followed by Rome (147,800) and Turin (100,800): these are the only cities with more than 100,000 square meters of sales area.

La Spezia and Trento are the cities that have seen the biggest increase in the number of stores compared to the end of 2023.

After Rome, which is in the top 10, among the cities of central Italy, Latina is the one with the highest number of stores (17 and 11th place in the national ranking), followed by Perugia (16 stores and 13th) and Florence (11 and 26th).

However, the Tuscan capital boasts a high total sales area, which places it 13th in the ranking by square meters.

In the south+islands area, the cities with the most stores are Cosenza (17th), Cagliari (19th) and Catanzaro (32nd). If we analyze the sales area, Naples (18th), Bari (21st) and Catania (25th) stand out.

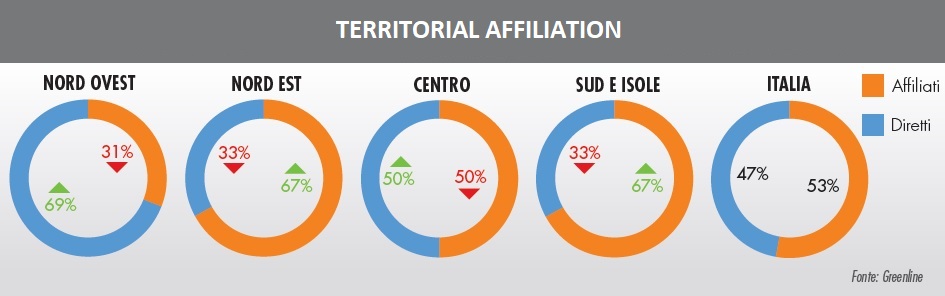

Affiliations and Purchasing Groups

“Affiliated” stores represent 53% of the total stores in Organized Distribution specializing in DIY and gardening in Italy. We refer to those independent retailers who decide to join a form of organized commerce, be it a franchise, affiliation with a large brand or membership in a consortium or purchasing group. Numerically, they are more prevalent in the north-east and south+islands areas compared to “direct” stores, i.e. those owned by the brands: in the first case, 201 affiliated/associated stores and 99 direct centers, in the second case 120 affiliated and 59 direct. While in the north-west, direct centers prevail: 194 against 88.

If we analyze the sales area instead, the ratios are totally in favor of direct stores. They represent 64% of the total area, with peaks of 75% in the north-west. The regions where “direct” stores represent the preponderance of the sales offer are Puglia (90.7%), Campania (90.6%) and Liguria (83.3%). Even the populous Lombardy (76.5%) and Emilia Romagna (76.8%) see the prevalence of the sales area of direct stores. On the contrary, the areas of affiliates prevail in Molise (100%), Trentino (93.4%), Basilicata (88.0%), Calabria (59.6%) and Sardinia (55%).

RESEARCH METHODOLOGY

To capture a snapshot of the organized retail sector specializing in DIY and gardening operating in Italy, we selected Retail brands and Purchasing Groups (Consortia) with at least 3 stores and a propensity for growth. The sales areas indicated refer to the covered areas dedicated to sales: parking lots, offices, and warehouses are therefore excluded.

By “direct” store we mean stores owned by the distribution group; by “affiliated” store we mean stores owned by private entrepreneurs who adhere to forms of distribution association, such as franchising, or affiliation with purchasing groups and consortia.

All data is provided by the brands themselves and processed by the author, who has been conducting this semi-annual Monitoring continuously since 1988. Any estimates are always specified in the graphs.

For further information: greenline@netcollins.com