The Italian DIY and garden market report (2/2024) – Part 2

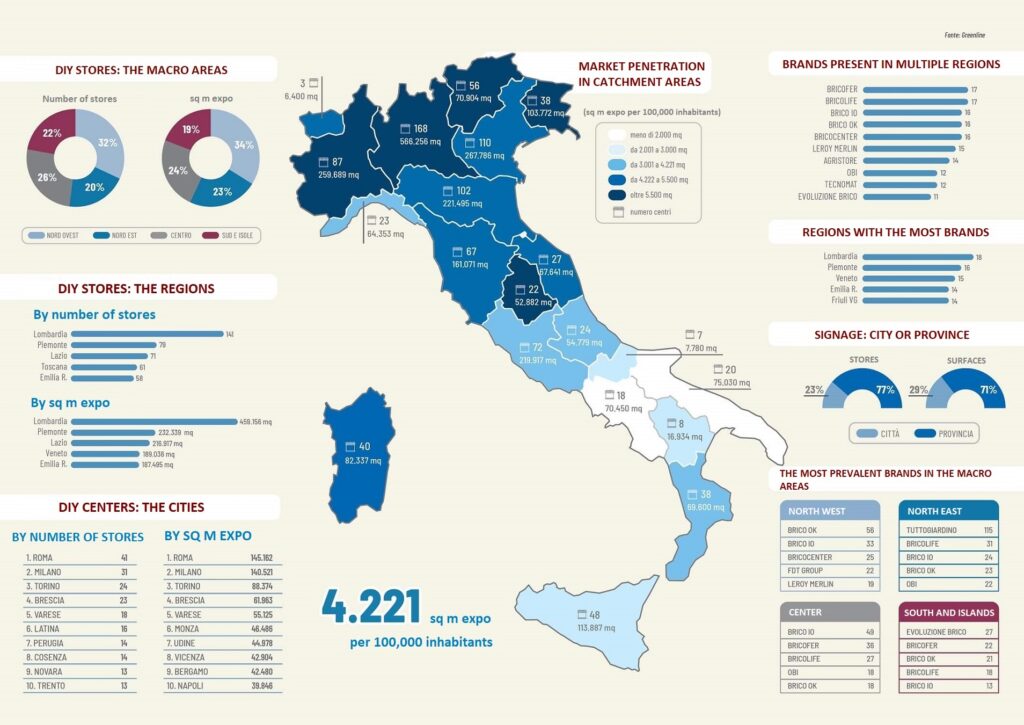

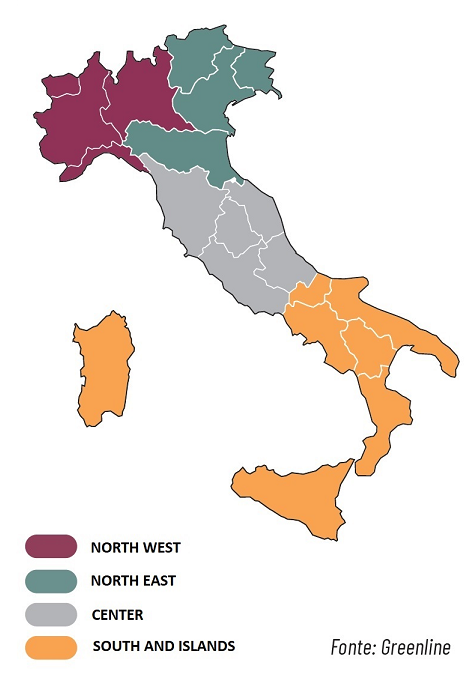

Keep notice. To better understand the text, it is important to keep in mind that Italy is conventionally divided into 4 macro-areas:

- The North West: Aosta Valley, Piedmont, Liguria, Lombardy

- The North East: Trentino-South Tyrol, Veneto, Friuli Venezia Giulia, Emilia-Romagna

- The Center: Tuscany, Umbria, Marche, Abruzzo, Lazio

- The South and Islands: Molise, Campania, Apulia, Basilicata, Calabria, Sicily, Sardinia

DIY and garden retail chains in 2024: affiliation

After the initial development in the 1980s with ‘direct’ stores, meaning owned by the distributing company, the Italian DIY and garden retail chains have developed over the past forty years primarily through affiliation programs. This formula has allowed many independent entrepreneurs, sometimes historical retailers in the sector, to join the benefits of a national group while maintaining their independence and sometimes even their own brand.

In fact, under the term ‘affiliation’ we can include various forms of modern distribution association, such as joining franchising formulas, affiliations, or supply contracts, up to joining purchasing groups, voluntary unions, and consortia among retailers. All formulas already successfully implemented by large-scale retail trade and applied with equally successful results in the DIY and garden market.

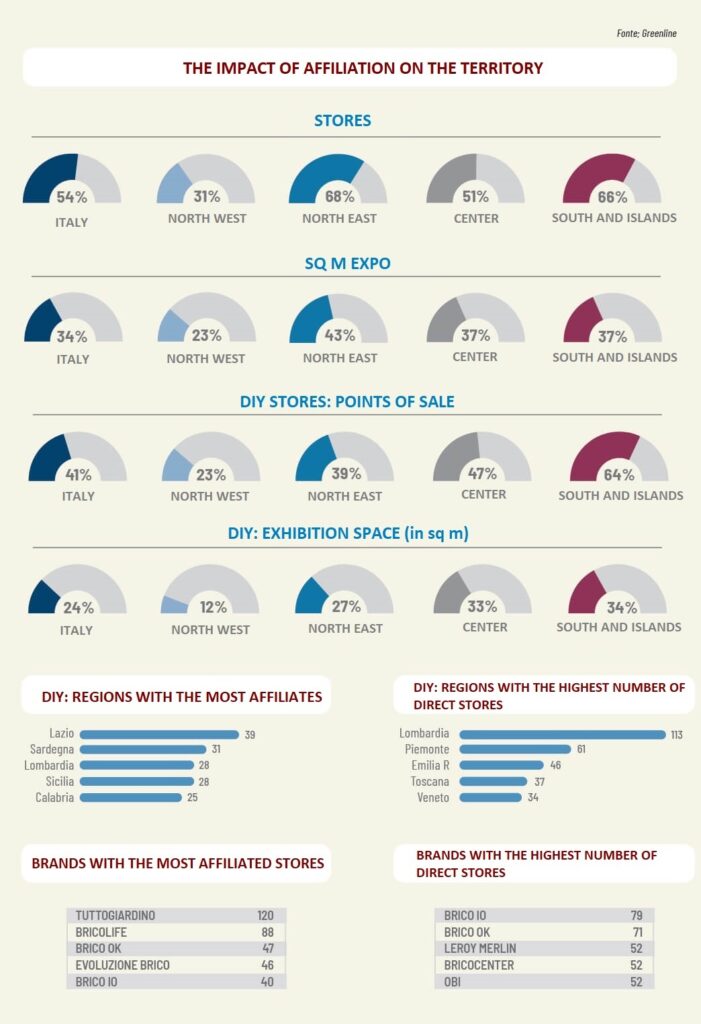

Direct stores, meaning those owned by the distribution group, represent 46% of Italian stores in 2024. The percentage rises to 69% in the northwest, but remains below 50% in other macro areas. However, if we analyze the exhibition spaces, the situation reverses, as direct stores are generally larger than affiliated ones. Affiliated stores represent ‘only’ 34% of the total exhibition space, with a peak in the northeast (43%) counterbalanced by the northwest (23%).

Since garden chains are almost entirely composed of stores affiliated with consortia or franchising solutions, we have extracted data relating only to DIY centers. In this case, the percentage of affiliated stores drops to 41%, with an exhibition area of 24%.

The southern regions and islands stand out with 64% of affiliated stores, representing 34% of the area’s exhibition space. In contrast, the northwest regions, where affiliation concerns 23% of the points of sale and ‘only’ 12% of the exhibition space, provide a counterpoint.

The regions with the highest number of DIY centers are, in order: Lazio (39 stores), Sardinia (31), Lombardy, Sicily (28), Calabria (25), Tuscany (24), Veneto (23), Piedmont, Trentino (18), and Abruzzo (13). Together they gather 247 stores, that is 78% of all DIY centers.

Direct stores are instead concentrated in Lombardy (113 DIY centers), Piedmont (61), Emilia Romagna (46), Tuscany (37), Veneto (34), Lazio (32), Marche (17), Friuli (16), Sicily (16), and Liguria (14). These ten regions gather 386 stores, equivalent to 86% of Italian affiliated DIY centers.

From DIY to home improvement

Not only has distribution evolved, but the very concept of “DIY” has also changed significantly over the decades. There is no precise birthdate for DIY, as the ability to build and adapt one’s home is likely inherent in humanity. Until the early 20th century, all heads of households had basic knowledge to “make do” around the house and were, in some way, handymen, perhaps unknowingly and reluctantly. The birth of the DIY hobby coincides with the economic boom from the mid-1960s, along with the introduction and development by industries of consumer tool and solution lines alongside professional ones. This trend arrived in Italy, imitating what was happening in Northern Europe. At that time, “do-it-yourself,” as the phrase itself indicates, was an invitation to make do, to replace artisans in building a bookshelf or replacing the kitchen faucet, primarily with the aim of saving money. Decoration and “creative DIY” arrived in the 1980s and today in Europe the term “home improvement” is used. This concept goes beyond manual skill, encompassing aesthetic as well as functional aspects and embracing both the home and the garden. Today, it is no longer necessary to have manual skills to be a regular at a specialized center, and it is not uncommon for the customer to be accompanied by the professional who will handle the installation.

How formats change

In order to meet the needs of the modern customer for “home improvement” products, store formats have also evolved. Alongside large stores, exceeding 5/7,000 square meters, smaller formats have also developed, more suitable for a local commerce.

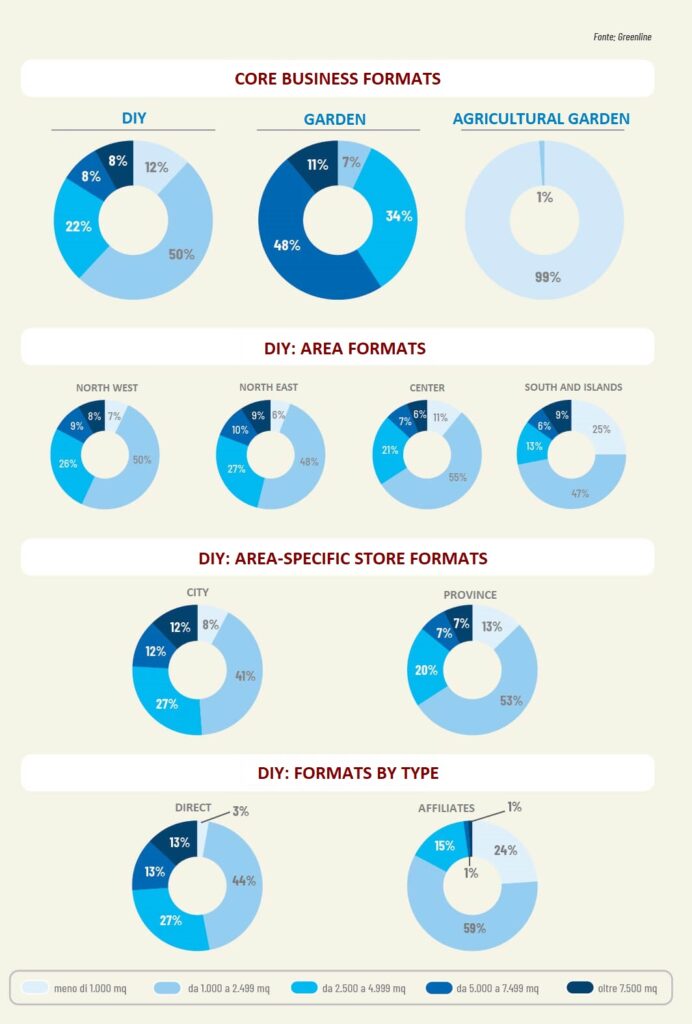

Of course, the type of offering also has a significant impact. Garden centers, often with a floricultural and nursery background, can rely on greenhouses, nurseries, and large spaces: 59% have an area of over 5,000 square meters. In contrast, agri-gardens, often evolutions of agricultural retailers, have smaller dimensions. DIY centers fall in between, and only 16% have an area of over 5,000 square meters. Half (50%) have an area between 1,000 and 2,500 square meters, while 22% occupy an area between 2,500 and 5,000 square meters.

Analyzing the DIY centers, which are numerically more consistent, in greater depth, we find that small stores, less than 1,000 square meters, are more prevalent in the southern regions: they represent 25% of all DIY centers in the macro area.

DIY centers located in cities are generally larger than those in peripheral municipalities: 24% of urban DIY centers are larger than 5,000 square meters, a percentage that drops to 14% in the provinces. Here, stores with less than 2,500 square meters are much more prevalent: they represent 66% compared to 49% in cities.

We also find significant differences in formats when comparing directly owned stores with affiliated ones. Chain-owned stores tend to be large, with 26% exceeding 5,000 square meters. Among affiliates, this percentage drops to 2%. In 83% of cases, affiliated DIY centers have an area of less than 2,500 square meters, of which 24% are less than 1,000 square meters. Only 3% of directly owned stores have an area of less than 1,000 square meters, and the percentage rises to 47% when considering stores with less than 2,500 square meters.

Brico-garden retailers in 2024

Even though we have written that the total number of stores is decreasing in 2024 and DIY centers have recorded a positive balance of only +4 stores, it’s worth noting that there were many more new openings last year, 33 to be precise. Partly offset by a series of closures and terminations of affiliation agreements and partly by the transition of some stores from one brand to another. As happened to the four Self stores in Asti, Alba (CN), Vercelli and Borgo San Dalmazzo (CN) that switched to Bricocenter last December.

Brico io has been particularly active in 2024, with the opening of four new affiliated stores in Deiva Marina (SP), Ischia (NA), the La Pigna shopping center in Amantea (CS), and Luino (VA): a performance that allowed the chain to close 2024 at the top of the ranking for the number of points of sale: a remarkable 119 in 16 regions.

Brico Ok has been committed in 2024 with the opening of four direct centers. In Sant’Angelo Lodigiano (LO) and Prata Camportaccio (SO) in the first half of the year, and in San Vito al Tagliamento (PN) and Motta di Livenza (TV) in the second half of the year.

Bricocenter resumed franchise development with the new affiliate in Trapani last June and acquired in December, as we mentioned, four Piedmontese Self stores. Above all, it worked on the restyling of some points of sale, according to the new “medium city” concept of the Groupe Adeo brand: as happened with the stores in Muggia (TS), Cinisello Balsamo (MI), Terni and Lecce Surbo. It is working on a new point of sale in Benevento, scheduled for next spring.

The Evoluzione Brico consortium, known for its DIY centers under the Bricolarge banner, has affiliated three new points of sale in Gela (CL), Caltagirone (CT), and San Vito al Tagliamento (PN). In March, it formalized an agreement with the Ferca group and the Brico Ware chain of the Cangianiello Group, for the creation of the Focus purchasing platform.

The development process of Tecnomat, the Groupe Adeo brand dedicated to construction, formerly known as Bricoman, continued in 2024 as well. Since entering the Italian market in 2008, it has always opened at least one store every year, including the Covid period: in fact, in 2021 it even opened four! Today it has 32 large-format points of sale, including the latest one opened in 2024 in Olbia (OT).

Another group that increases its affiliates every year is the Fdt Group consortium. In May 2024, it inaugurated the new associate in Piazza Armerina (EN).

Among the consortia, Bricolife also deserves a mention. After the significant growth of 2023 with five new affiliates, it expanded its network in 2024 with the store in Lucrezia di Cartoceto (PU).

The German group Obi also expanded its presence in Italy with the new direct point of sale in La Spezia, inaugurated last February: it is one of the largest stores inaugurated in 2024.

Last year, chains not particularly active in development also inaugurated new stores. In May, Utility inaugurated the new direct store in Arona (VB), bringing the chain to 21 points of sale. In June, Pronto Brico Hobby, a brand active in Calabria, inaugurated its 6th direct store in Catanzaro.

Research methodology. The ‘Specialized Large-Scale Retail DIY-garden Monitoring’ is a biannual survey that the author has been conducting continuously since 1988. To analyze the evolution of specialized organized retail formats in DIY and gardening operating in Italy, we have selected the Specialized Large-Scale Distribution brands and Purchasing Groups (consortia, voluntary unions, etc.) that meet two main requirements: the presence of at least 3 points of sale and a propensity for development, i.e., the systematic opening of new owned (direct) or affiliated points of sale. The indicated exhibition areas refer to covered areas intended for sale: therefore, parking lots, offices, and warehouses are excluded. By ‘direct’ points of sale, we mean stores owned by the distribution group; by ‘affiliates,’ we mean stores owned by private entrepreneurs who adhere to distribution association formulas (such as franchising) or affiliation with purchasing groups and consortia. All data are provided by the brands themselves and processed by the author. The rare estimates are always specified in the graphs.